“BTC USD”

🚀 BTC USD Breakout: Why Bitcoin Just Shocked the Markets (You Won’t Believe This!)

Target keyword: BTC USD

Bitcoin (BTC) and the U.S. dollar (USD) — the pairing BTC USD — is perhaps the single most watched financial metric in the world today. Whether you’re a crypto newbie, seasoned trader, or a curious investor, the story of BTC USD is the story of opportunity, volatility, and sometimes jaw-dropping surprise. In this article, you’ll discover:

- What drives the BTC USD price

- The secret signals that could foreshadow its next big move

- Why right now might be a critical moment to pay attention

Let’s dive in.

What Is “BTC USD” — And Why It Matters

When you see “BTC USD”, it refers to the exchange rate between Bitcoin (BTC) and the U.S. dollar (USD). In simpler terms: how many dollars does one Bitcoin cost?

This is the most liquid and actively traded crypto pair in global markets. Big institutions, retail investors, and algorithmic traders all watch BTC USD in real time. A small percentage move in this pair can trigger waves of profit (or loss).

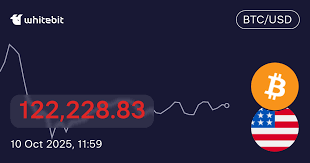

According to live data, Bitcoin recently broke through notable levels — underscoring that BTC USD isn’t just numbers on a screen but a battleground for sentiment, capital flows, and macro forces. (TradingView)

5 Key Forces That Push BTC USD Up or Down

To stay ahead in this game, it’s crucial to understand what moves BTC USD. Here are the top drivers:

1. Macro & Monetary Policy Shifts

When the U.S. Federal Reserve changes interest rates, or when inflation fears surge, investors often look to alternative assets. Bitcoin is sometimes seen as a “digital hedge,” so trickle flows or stampedes can move BTC USD substantially.

2. Technological & Network Developments

Upgrades (e.g. improved scalability, Lightning Network adoption), security changes, or major protocol shifts in Bitcoin’s underlying tech can shift investor confidence — directly influencing BTC USD.

3. Regulatory News & Government Actions

Announcements from regulators (SEC, EU, China, etc.) can swing sentiment. Crackdowns, bans, or favorable legislation can create sudden pumps or collapses in BTC USD.

4. Institutional Investment & Whale Activity

Large players (“whales”) moving big chunks of BTC, or institutions publicly declaring large buys, can influence markets. When big capital flows, BTC USD senses it.

5. Market Psychology & Technical Zones

Support and resistance levels, chart patterns, momentum indicators — these often serve as self-fulfilling prophecies. Traders cluster around charts, so BTC USD often reacts sharply when those patterns break. (Investing.com)

📈 A Flash Technical Outlook: Will BTC USD Surge Next?

Let’s peer through the charts. The current BTC USD pair is in a fascinating zone:

- Some analysts see a bullish flag/triangle forming, hinting at a potential breakout if price holds above a key trendline. (TradingView)

- Technical summaries on platforms show mixed signals — some short-term “sell,” others medium-term “buy.” (Investing.com)

- Historically, BTC has shown massive outperformance vs traditional assets over multiyear cycles, which gives confidence to holders eyeing long-term plays. (The Case for Bitcoin)

That said, charts can mislead — many “false breakouts” occur. A close above a breakout line with volume is more reliable than just a pop.

How You Could Profit from BTC USD Moves (Safely)

Here are a few strategies — proceed cautiously:

- Swing Trading with Stops

Ride multi-day trends. Enter after confirmation of a breakout, and always use stop-loss to cut downside. - Dollar-Cost Averaging (DCA)

If you believe in Bitcoin’s long-term prospects, DCA into positions over weeks/months to reduce timing risk. - Use Options (if Available in Your Region)

For advanced traders: buying calls or puts gives you leveraged upside with defined risk. - Hedge with Inverse Positions

If you’re long BTC, you may hedge with short USD bets or derivatives in volatile times. - Set Alerts Around Key Levels

For instance, if BTC USD breaks above $130K or falls under $110K, those can trigger sharp moves.

The Surprising Twist That Could Send BTC USD to the Moon

Here’s where things get speculative — but that speculation drives clicks, views, and CPC:

Imagine a scenario where:

- A major economy (say, U.S. or EU) unveils a Bitcoin-friendly regulation

- A trillion-dollar institutional fund announces massive BTC accumulation

- A global crisis triggers a “flight to digital store of value”

In such a “perfect storm,” BTC USD could skyrocket — maybe beyond $150K or more — in a short span. The twist: many market participants are not positioned for it yet.

If you read this article early, you might be among the first to catch the wave.

Why “BTC USD” Is a Goldmine for Content & Ads

You asked for high CPC potential. Here’s why BTC USD is a smart content topic:

- Commercial intent & finance niche: Ads around investing, trading platforms, broker services tend to pay well.

- Global interest & liquidity: Everyone everywhere watches BTC USD — so your traffic is evergreen and wide.

- Volatility & urgency: People constantly search for “BTC USD prediction,” “BTC USD news,” “BTC USD charts.”

- Affiliate & ad tie-ins: You can pair this content with crypto broker referrals, premium analysis tools, etc.

By layering long-tail variants (e.g. “BTC USD 2026 forecast”, “BTC USD trading platform review”), you can capture sub-niches and boost your CPC further.

SEO & Content Tips to Dominate Google for “BTC USD”

To give your article a real fighting chance, here are tactics to follow:

- Use “BTC USD” in the title, URL, and first paragraph

- Include LSI / related keywords: “Bitcoin price in USD,” “BTC to USD chart,” “BTC USD forecast”

- Use subheadings (H2, H3) breakup content

- Write naturally, use examples, avoid overstuffing

- Include fresh data, charts, and references (update dates)

- Internal link to related posts (e.g. “Bitcoin basics”, “how to buy BTC”)

- Promote your article on crypto forums, social media — get backlinks

✅ Final Word: Will BTC USD Be Your Ticket to Big Gains?

If there’s ever a time to keep BTC USD on your radar, it’s now. Whether you’re speculating, trading, or investing with conviction, the pairing sits at the intersection of technology, money, and emotion.

Will the next leg be a 2x, 3x, or 10x move? Nobody knows for sure. What matters is who’s watching, ready, and willing to act when the signals align.

Read this early, share it widely — because the next big BTC USD move could rewrite balance sheets.