“S&P 500”

S&P 500: The Ultimate Guide to Understanding and Profiting from America’s Top Stock Index

If you’ve ever searched for how to build wealth or where to invest your money safely, chances are you’ve come across the term S&P 500. It’s one of the most powerful phrases in global finance — representing not just a stock index, but a mirror of the U.S. economy itself.

In this article, we’ll break down what the S&P 500 is, why it’s so important, how you can invest in it, and how people around the world are making consistent profits from this legendary index. Let’s dive in.

What Is the S&P 500?

The S&P 500 (Standard & Poor’s 500 Index) is a list of the 500 largest publicly traded companies in the United States, compiled and maintained by S&P Dow Jones Indices.

It includes big names you already know — Apple, Microsoft, Amazon, Google (Alphabet), Tesla, Meta (Facebook), and more. Together, these companies represent about 80% of the total U.S. stock market capitalization, making the S&P 500 the most accurate snapshot of America’s financial health.

Think of it as a “report card” for the U.S. economy. When the S&P 500 rises, it usually means most major companies are doing well. When it drops, it signals trouble in the market.

Why the S&P 500 Matters Globally

Even if you don’t live in the U.S., the S&P 500 affects you. That’s because it influences global investment trends, currency values, and economic confidence worldwide.

- Foreign investors watch it daily to gauge where to move their money.

- Central banks consider it when adjusting interest rates.

- Tech giants, energy firms, and banks within the index impact nearly every sector of global trade.

When you hear headlines like “S&P 500 hits record high,” it’s often followed by rallies in markets across Europe and Asia too.

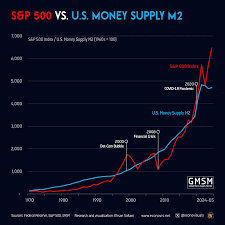

S&P 500 Historical Performance: Why Investors Love It

Over time, the S&P 500 has been one of the most profitable investments ever.

From its creation in 1957 to today, the index has returned an average of about 10% per year — even after accounting for inflation and market crashes.

If you had invested $1,000 in the S&P 500 in 1990, it would be worth more than $25,000 today (with dividends reinvested). That’s the magic of compound growth — and why financial advisors worldwide recommend index investing.

How to Invest in the S&P 500

You don’t need to be a Wall Street expert to invest in the S&P 500. Thanks to modern financial tools, anyone — from a student to a retiree — can buy shares linked to it.

Here are three popular ways:

- S&P 500 ETFs (Exchange-Traded Funds)

- Example: SPDR S&P 500 ETF (SPY) or Vanguard S&P 500 ETF (VOO).

- These funds mirror the performance of the S&P 500 and are among the world’s most traded investments.

- S&P 500 Index Mutual Funds

- Managed by companies like Fidelity or Vanguard, these funds are perfect for long-term investors who prefer automatic contributions and diversification.

- Fractional Investing Apps

- Platforms like Robinhood, eToro, and Fidelity Go allow you to buy fractional shares of S&P 500 ETFs, starting with as little as $10.

Why the S&P 500 Is a Safe Bet for Long-Term Growth

The beauty of the S&P 500 lies in diversification. Instead of betting on one company, you’re investing in 500 of the strongest corporations across different sectors — tech, healthcare, finance, energy, and consumer goods.

When one sector falls, another often rises, balancing your portfolio naturally. Over time, this makes the S&P 500 a less risky and steadier investment compared to buying individual stocks.

Plus, companies in the S&P 500 are screened for financial strength and stability, meaning you’re investing in leaders that drive innovation and economic growth.

Top Companies in the S&P 500 (2025 Edition)

As of 2025, here are some of the most influential companies in the index:

| Rank | Company Name | Sector | Market Cap (Approx.) |

|---|---|---|---|

| 1 | Apple (AAPL) | Technology | $3.2 Trillion |

| 2 | Microsoft (MSFT) | Technology | $3.1 Trillion |

| 3 | Amazon (AMZN) | E-commerce | $2.0 Trillion |

| 4 | Nvidia (NVDA) | Semiconductors | $2.4 Trillion |

| 5 | Alphabet (GOOGL) | Internet Services | $2.1 Trillion |

| 6 | Meta Platforms (META) | Social Media | $1.3 Trillion |

| 7 | Berkshire Hathaway (BRK.B) | Financials | $900 Billion |

These seven giants alone make up nearly 30% of the entire index’s value, showing how tech innovation dominates today’s market.

S&P 500 vs. Other Indexes: What Makes It Special

Many investors compare the S&P 500 with other global indices like the NASDAQ 100, Dow Jones Industrial Average, or FTSE 100.

Here’s why the S&P 500 often comes out on top:

- Better diversification: 500 companies vs. 30 in the Dow Jones.

- Balanced weighting: Combines large-cap stability with sector variety.

- Historical consistency: Has beaten most managed funds over long periods.

Simply put, it’s the gold standard for measuring U.S. market performance.

How to Profit from S&P 500 Volatility

While the S&P 500 is reliable long-term, short-term traders love its daily price movements.

Here’s how investors capitalize:

- Swing trading ETFs based on short-term momentum.

- Options trading on S&P 500 futures for leverage.

- Dollar-cost averaging for long-term consistency, especially during dips.

Remember, the key isn’t timing the market — it’s time in the market that builds wealth.

S&P 500 Predictions for 2025 and Beyond

Experts believe the S&P 500 could reach 6,000 points or more by 2026, driven by advancements in AI, clean energy, and semiconductor technology.

However, factors like interest rate cuts, inflation trends, and geopolitical stability will continue to influence its performance.

For long-term investors, these dips and spikes are golden opportunities to buy low and hold strong.

Final Thoughts: Why the S&P 500 Should Be in Every Portfolio

If you’re serious about building long-term wealth, the S&P 500 is non-negotiable.

It offers:

✅ Proven returns over decades

✅ Global exposure to world-class companies

✅ Diversification that reduces risk

✅ Access for small and big investors alike

Whether you invest through ETFs, mutual funds, or fractional shares, the S&P 500 remains the smartest and most accessible gateway to financial freedom.

🔥 Pro Tip for Smart Investors:

Start with automated monthly investments in an S&P 500 ETF — even $50 a month can grow into tens of thousands over time, thanks to compound interest.

So next time you hear “S&P 500 hits new record,” remember — that could be your money growing, quietly and steadily.